Financial markets news: 2022 midyear review

Looking beyond the headlines

Article published: August 08, 2022

The first half of 2022 has been turbulent. It’s possible that you are unsettled by the market’s decline and the potential for a recession. However, at Edelman Financial Engines, we believe both the U.S. economy and your financial situation may be stronger than the news headlines might have you think.

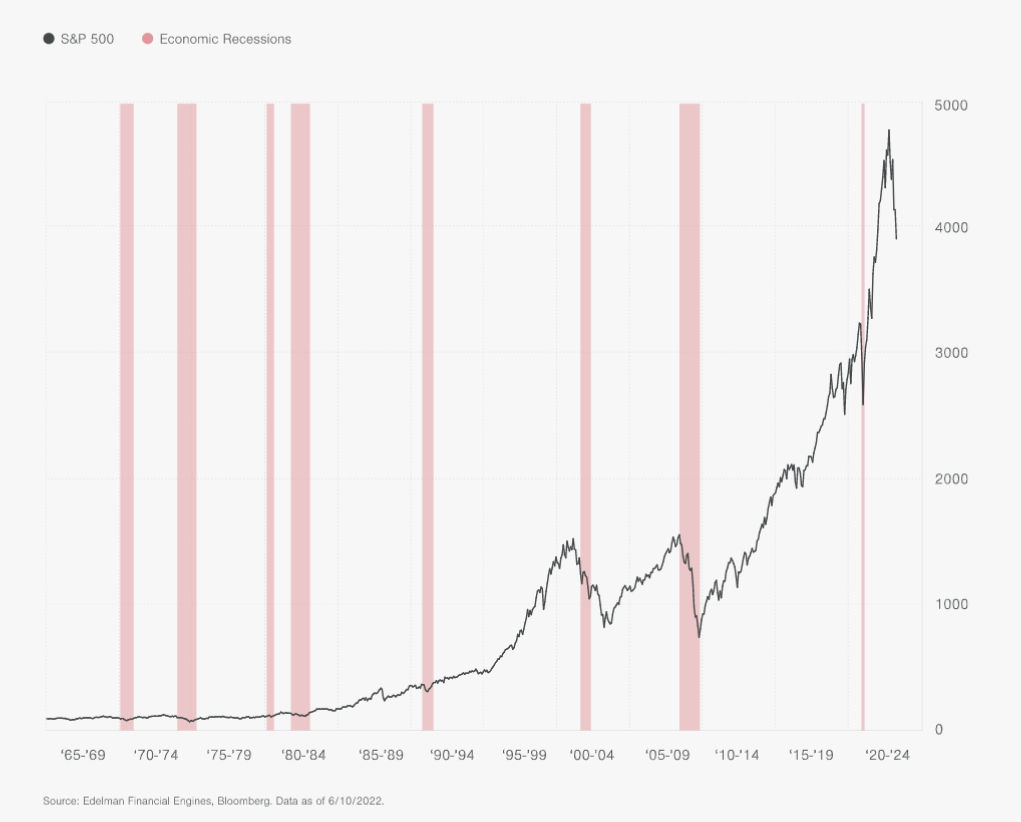

To provide some perspective, there have been 10 bear markets and eight recessions since 1965 alone, all followed by bull markets and healthy periods of economic growth. Bear markets and economic recessions are natural parts of market and economic cycles.

Our financial planning process incorporates market and economic cycles into its assumptions because it was designed to provide for our clients through their retirement, not just one to two years. We work closely with our clients to help protect their wealth in a variety of economic and market conditions.

We invite you to read our insights below to put today’s markets and economy into greater context. Then, take the questionnaire at the end to see if it’s time to consult with a planner.

The markets

What happened

The first half of 2022 opened with mounting anxiety that a series of anticipated rate hikes by the Federal Reserve could push the economy into recession. The result? Markets went into a tailspin. Bonds posted their sharpest losses in decades, and the S&P 500 entered bear market territory (technically, when an index is 20% below its recent peak).

In June, the markets remained vulnerable to big swings amid uncertainty about whether inflation will worsen and how inflation will impact the Fed’s rate hike trajectory. The S&P 500 ended the first half of 2022 down 20.6%. The Bloomberg U.S. Aggregate Bond Index fell 10.4%.

The markets are forward looking, so the direction of the market will be determined by a positive or negative change in expectations. You may be in the pessimist camp if you focus on the financial headlines.

What the headlines say

Every day, there is news about a range of factors that could trigger another market sell-off: the war in Ukraine, inflation, rising rates and the possibility of recession. You may expect market declines to get worse. You may want to make changes to your portfolio. Both stocks and bonds are down, so maybe you’re exploring alternative investments. Perhaps you want to increase your cash allocation because you think it will protect your wealth from further losses.

Our View

Press pause and consider this: Your financial position may be stronger than you think

If you’re working with a fiduciary financial planner, you and your planner likely engage in a detailed financial planning process to help you achieve your goals. Consider the steps you may have taken to help protect your financial security. If you’re not working with an advisor, contact us today for a no-obligation consultation.

True, the markets are down, but your financial plan may not just focus on investments. Make no mistake – a well-diversified portfolio is an important part of a wealth management plan. But, your plan may go further to connect all aspects of your financial life. Edelman Financial Engines takes a modern, integrated approach to building your wealth.

Find ways to derive greater value from all of your assets

These approaches may include tax strategies and different kinds of insurance to protect your loved ones and yourself. You may have an estate plan in place to ensure your family is provided for in the future. There is income from Social Security and perhaps pensions. All of this and more help protect your wealth even when the market declines. A financial planner can work with you to integrate all of these aspects of your wealth.

Portfolio diversification can be particularly important in periods of uncertainty such as ours

At Edelman Financial Engines, we work together to create a portfolio that seeks to provide for you through retirement – even as it may experience volatility in the short term. We diversify your portfolio across as many as 17 asset classes, so your portfolio spreads out investment risk as well as its exposure to upside opportunities. For example, although many asset classes are down so far in 2022, diversified portfolios of many of our clients are capturing the upside of energy stocks, which were among the market’s underperformers in recent years.

In fairness, it can be hard to see the advantages of diversification in the short term because asset correlations can rise for abbreviated periods before resuming their historical relationships. For example, bonds and stocks fell at the same time at the start of 2022 but have since become less correlated. We believe a well-diversified portfolio of bonds and stocks should help achieve returns that can exceed inflation over the long run.

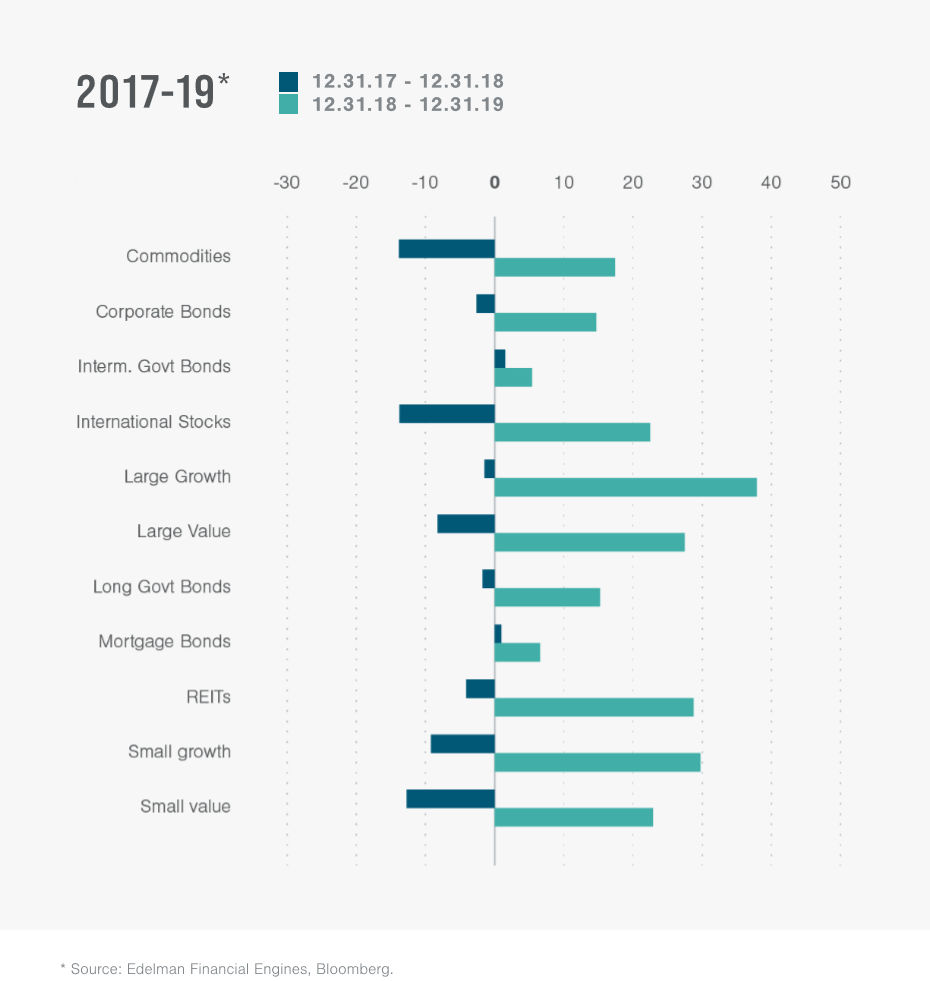

The difficulty of market timing and the value of diversification

Performance among asset classes, whether stocks or bonds, can vary widely from year to year, especially during bear markets and their recoveries. If a portfolio is diversified across a range of asset classes, it may create the opportunity to capture attractive, though unpredictable, asset class returns.

Think again about moving into cash

It’s next to impossible to time the markets and to know which asset classes or individual securities will be the best performers from year to year (see visual above). It’s only logical, then, that you can’t predict market tops or bottoms either. That’s why, we believe moving part or all of your portfolio into cash as a way to avoid further portfolio losses has its own risks.

- You likely won’t be able to time when to reinvest to fully capture large recovery rallies, rallies that your portfolio would need to make up lost ground.

- Some of the biggest one-day rallies have occurred when expectations have changed during bear markets. That’s because markets are forward looking.

If you partly liquidate your portfolio and place that cash in a money market account, then you will have locked in those market drawdowns without the potential to benefit fully from an equity market recovery.

In addition, yields on those money market accounts are far below the rate of inflation, so your cash would be losing purchasing power.

Still unconvinced? How about a metaphor. Let’s say you’re driving from New York City to Los Angeles. When you get to Chicago, there is a maddening traffic jam. After an hour of being bumper to bumper, you decide you will make more progress by walking. Do you really get out of the car?

Resilience

Over the decades, the stock market, as represented by the S&P 500, has recovered from steep declines brought on by economic recessions.

LOOKING AHEAD

We believe the market has priced in expected rate hikes and the possibility of a recession.

- The stock market can be a leading indicator, but not always an accurate one. Since 1965, we have had 10 bear markets, but eight recessions.

- While there remains a lot of uncertainty about whether the Fed can achieve a soft landing, there is always uncertainty in the markets.

- Since 1946, it has taken 14 months on average for a bear market to hit its bottom. Our planners use a financial planning process that accounts for more than one to two years. For many clients, the process accounts for 20 to 30 years or more.

Because both bull and bear markets are natural parts of the economic cycle, our planners incorporate them when planning for our clients’ financial future. That’s why our planners may discuss having cash reserves and insurance strategies and may review client’s discretionary expenses – all to help protect our clients’ wealth. We are their partners and want them to have the flexibility to navigate what lies ahead to achieve their long-term financial goals.

The economy

What happened

Inflation delivered a shock to the U.S. economy in the first half of 2022 when it surged to 40-year highs after more than a decade of near hibernation. The war in Ukraine, Covid-related lockdowns in China and slow reopenings elsewhere all conspired to exacerbate supply-chain disruptions. The distressed global supply-chain fueled inflation and sent the Fed on its rate hike trajectory. First quarter U.S. gross domestic product contracted by 1.5%, with economists partly blaming the decline on supply-chain disruptions depressing imports.

That was only part of the economic story. Beneath the GDP contraction, consumer spending remained strong thanks to a robust labor market. Nonfarm payroll gains averaged more than 480,000 per month, maintaining the tightest job market in decades and driving wage gains. Headlines don’t always focus on the good news however.

What the headlines say

The news is replete with stories on the possibility of recession. Some headlines even mention “stagflation” – high inflation coupled with high unemployment and sluggish demand. At this point, you may assume a recession is inevitable. The reality is that the economy has both tailwinds and headwinds. Let’s put the economy into perspective for your finances.

Our View

The Fed has a tough challenge ahead of it. Not all factors fueling inflation are in the Fed’s control, like the war in Ukraine. The question is: How does the Fed execute an intense monetary tightening regime without driving the economy into a recession?

It’s natural to be unsettled about the possibility of a recession. Let’s remember economic slowdowns, and even recessions, are simply a part of the economic cycle that can lead to periods of solid growth. There are ways to help gird your finances for economic weakness, for example, setting aside cash reserves that provide for you over a one- to two-year period.

We agree with most economists that heightened inflation is not here to stay and expect it to ebb over the next couple of years, with some key drivers being transitory, such as China’s lockdowns. We don’t believe two or three years should impact your long-term financial planning, which may assume a period of 20 to 30 years if you’re retired, and more if you aren’t yet.

ECONOMIC FUEL

- Robust labor market

- Strong consumer spending and wage growth

- Supply-chain issues may get some relief

INFLATION Tip

It may be helpful to look beyond aggregated government data on inflation like the Consumer Price Index and think about your “personal inflation rate.” For example, which of your ongoing costs have risen? A planner can discuss with you how you may want to adjust your finances to manage your personal inflation rate.

Looking Ahead

We expect the Federal Reserve’s rate hikes will create an economic slowdown. That’s what they are intended to do. While a recession is a possibility, we don’t see it as a foregone conclusion.

CONSIDER THESE FACTS:

- The second quarter 2022 Survey of Professional Forecasters, a group of prominent economists, still forecasts the U.S. economy to grow in 2022 and 2023.

- The healthy job market is supporting solid consumer income and spending.

- Market-based indicators expect a decline in heightened inflation over the next two years (see chart below).

Follow the data, not your emotions. Fears of a recession don’t predict actual recessions. If you have any concerns or questions about how a potential recession will affect your finances, please don’t hesitate to contact an Edelman Financial Engines planner. We’re here for you.

The market is signaling an inflation decline

The first half of 2022 saw inflation rise to over 8%, its highest in 40 years. But market indicators see the rate of inflation declining in the next two years and “normalizing” to around 3% five years from now.

Questionnaire: Should you consult with a financial planner?

Answering “yes” to even one of these questions may mean it’s time to consult with a planner.

- Are you retiring in less than three years and wondering about how the market’s decline will impact your plans?

- Tax codes change every year. Have you updated your tax strategies?

- Have you changed jobs or are you thinking of changing jobs?

- If you are in retirement, do you think you may need to change your withdrawal rate?

- Estate plans need to be reviewed every three to five years or when life changes occur. Do you need to revisit your estate plan?

Schedule a free, no-obligation consultation with a financial planner today.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

An index is a portfolio of specific securities (such as the S&P 500, Dow Jones Industrial Average and Nasdaq composite), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index.

Past performance does not guarantee future results.