Is the Us Dollar Losing Its Crown?

The ol’ greenback fights off pretenders to the throne.

Article published: January 05, 2026

Lately, the chatter around “de-dollarization” has gotten louder. From TikTok finance influencers to global think tanks, everyone seems to be asking: Is the U.S. dollar’s reign as “the world’s currency” coming to an end? With America’s rising debt, inflation worries and the rise of alternatives like gold and digital currencies, it’s easy to see why the question is trending.

But while the headlines scream uncertainty, the numbers whisper stability. The dollar isn’t just holding on – it’s still the heavyweight champ of global finance, the go-to place and ideal that other currencies are measured against.

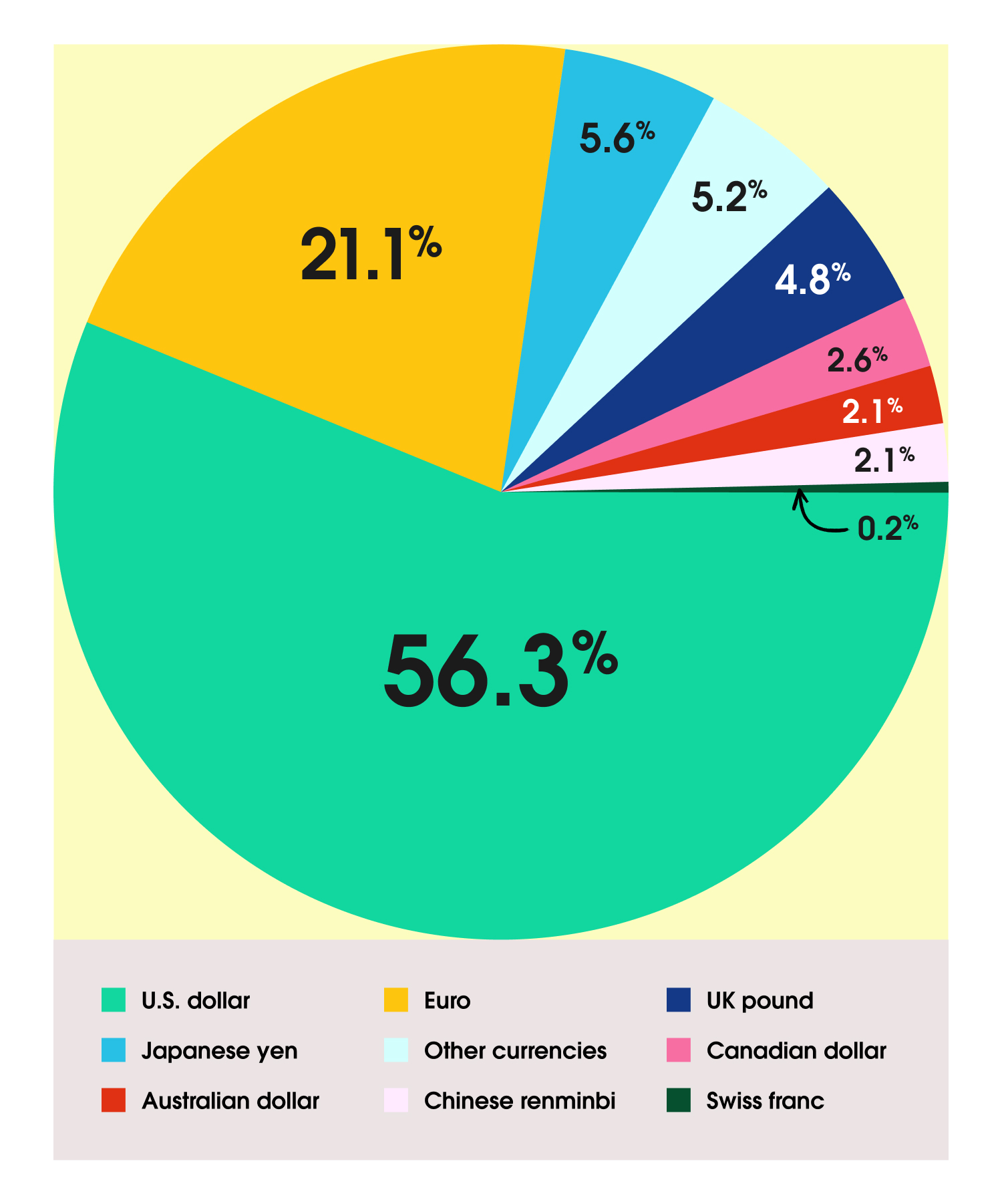

US Dollar Share in Global Reserves (Q2, 2025)

Source: International Monetary Fund Data Brief: Currency Composition of Official Foreign Exchange Reserves

WHY THE DOLLAR STILL DOMINATES

Yes, the U.S. has its fiscal challenges. Debt is high, and interest payments are climbing. That’s sparked fears that the Fed might tolerate more inflation to ease the burden, which could continue to weaken its purchasing power. Add in the buzz around BRIC (Brazil, Russia, India, China) countries trading in their own currencies, and it’s natural to wonder if the dollar’s days are numbered.

But let’s zoom out.

- Many other developed economies are also facing high debt payments – the U.S. is not unique.

- Nearly 90% of global currency transactions still involve the U.S. dollar.

- It remains the largest share of central bank reserves. The euro’s share has actually shrunk and the Chinese renminbi makes up only about 2% of global reserves, held back by tight capital controls and limited transparency.

No other currency offers the same mix of deep markets, legal protections and global trust. The dollar may wobble, but it’s built on bedrock.

GOLD AND ‘DIGITAL GOLD’: HYPE VS. HISTORY

Gold tends to shine when inflation fears rise. But as a long-term investment? Not so golden. Once fear dissipates, it can fall back to earth as quickly as it rose.

Here’s something gold promoters won’t tell you: After peaking in 1980, gold posted negative returns for two decades. Meanwhile, the S&P 500 soared.

The truth is that gold doesn’t generate income or growth – not a compelling case for a core investment.

Cryptocurrencies, often dubbed “digital gold,” are even more speculative. They might play a role in future financial systems, but for now, they’re highly volatile and unproven. A small, experimental allocation might suit adventurous investors, but only if they’re ready for a wild ride (and the possibility of a total loss).

GLOBAL STOCKS: A SMARTER HEDGE?

If you’re worried about dollar weakness, international stocks may offer a more practical solution. When the dollar drops, foreign stocks priced in dollars automatically get more valuable. We don’t have to go back to the ’80s for evidence of this one – in 2025, the weaker dollar helped boost international stock returns.

And unlike gold, global stocks represent businesses that can generate profits, growth and dividends. They’re not just a hedge; they can be a growth engine delivering value no matter what the dollar does.

BOTTOM LINE: DON’T COUNT OUT THE DOLLAR

The dollar’s dominance isn’t about being flawless – it’s about having no real rival. A sudden collapse of the dollar wouldn’t benefit anyone.

Yes, there are challenges. But trust, liquidity and institutional strength still make the greenback the world’s default currency. For investors, it may not be the smartest move to bet against it. Stay diversified, balanced and focused on the long term and your goals.

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

An index is a portfolio of specific securities (such as the S&P 500, Dow Jones Industrial Average and Nasdaq composite), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

Past performance does not guarantee future results.

AM5073338

.png)