The Fed Is Stuck Between a Rock and … Another Rock

Looking at inflation, jobs and what comes next.

Article published: January 05, 2026

Going into 2026, the Federal Reserve is in a tough spot. After several years, inflation’s still hanging around, and now employment opportunities are shrinking. Unfortunately, “you had one job” doesn’t apply to the Fed: They’re supposed to keep prices stable and keep people working.

For some, that means Rolling Stones lyrics aren’t the only echoes of the ’80s this scenario brings up; it’s starting to feel like we’re flirting with “stagflation-lite,” an unpleasant combination of a stagnating economy and sticky inflation. And for investors, there’s another concern: What happened to the possibility of falling interest rates?

THE FED’S DUAL MANDATE: A BALANCING ACT

The Fed’s job is to juggle two priorities: Stable prices (aka low inflation) and maximum employment (aka a strong job market). And that means they’re always walking a fine line as they wield their magic weapon: interest rates.

Raising interest rates can cool inflation but also slow hiring. Lowering rates can boost business investment – increasing jobs – but risk overheating the economy with higher inflation. That’s why the Fed’s independence from political pressure matters so much; it lets them make tough calls based on data, not gamesmanship.

So when both inflation and the job situation are less than ideal, it’s tough for the Fed to know where to aim their only weapon.

STICKY INFLATION AND A SHIFTING LABOR MARKET

The tricky situation we’re in now began almost six years ago with the pandemic price surge, when supply chain chaos and stimulus checks sent inflation soaring. While those pressures have eased, new ones have taken their place: Tariffs and global tensions are keeping prices stubbornly high. Unlike “normal” inflation, the kind of “sticky” inflation we’re seeing now could persist even as the economy is slowing.

In response, the Fed has suggested it might tolerate inflation above its usual 2% target to prioritize jobs (which hints at potential continued interest rate drops).

Meanwhile, the labor market is evolving: Low pandemic immigration and an aging workforce kept unemployment low and wages high for a few years. But now, job openings are shrinking and wage growth is cooling.

Fed Chair Jerome Powell called it “a curious kind of balance”: not too hot, not too cold, but still vulnerable to shifts in demographics, immigration and broader economic momentum. It makes it hard to know what to expect from inflation in the future.

THE FED’S MOVES: HARD TO PREDICT

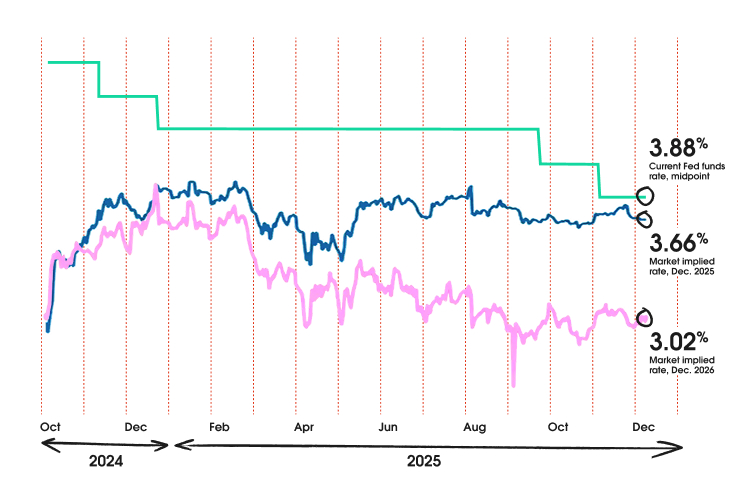

As in 2024, what investors thought the Fed would do with interest rates in 2025 didn’t match what actually happened. Rates have persistently remained higher than the markets are betting on.

The Fed is hard to predict: The Fed cut much less than expected going into the year, and 2026 is up for grabs

Source: Bloomberg; To perform the calculations for this Fed funds futures model, the World Interest Rate Probabilities collects price data for a list of assets from the futures market and uses this data to derive interest rate projections for each upcoming Federal Open Market Committee meeting.

It’s always the case that the Fed can surprise us, as they did in 2022 when they hiked rates aggressively after realizing inflation wasn’t just a temporary blip. But predicting future interest rates is harder than ever at this point. It depends on a mix of factors: prices, wages, trade, consumer spending and more.

WHAT IT MEANS FOR YOU

As an investor, the best way to prepare for any potential Fed path is to build a resilient portfolio: Diversify across asset classes and geographies. Stay disciplined; don’t chase trends or panic. Think long term, well beyond temporary market shifts. The Fed’s path may be rocky, but yours doesn’t have to be.

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

Past performance does not guarantee future results.

AM5076035