Roller Coasters Aren’t for Everyone: Volatility in 2025

2025 was great if you enjoy that stomach-dropping high.

Article published: January 16, 2026

By: Bill Tracy, Portfolio Manager

Innovation isn’t just for AI; it’s found in every corner of tech, including ones you might not think of, like, say … roller coasters.

For coaster enthusiasts, no amount of adrenaline is enough, and the tech needs to keep finding new ways to thrill them; Six Flags Over Texas is about to launch a six-world-record-holding behemoth in 2026 that includes something called a “giga dive.”

But when it comes to investing? Most of us would prefer a smoother ride. Still, 2025 gave us a bit of that coaster-style excitement. And while the year is ending on a high note, it wasn’t all loop the loops and cheers. Let’s roll tape.

FROM FREEFALL TO RECOVERY

The S&P 500 was up a healthy 15% as the end of the year closed in, which might make it easy to forget the “great large growth bear market of 2025.” Between mid-February and early April, the S&P 500 Growth Index – packed with tech and communication giants – plunged more than 22%. At the same time, the CBOE Volatility Index (aka the VIX, a technical measure of investor “jitters”) spiked to levels we hadn’t seen since the early pandemic days of 2020. Investors were bracing for impact.

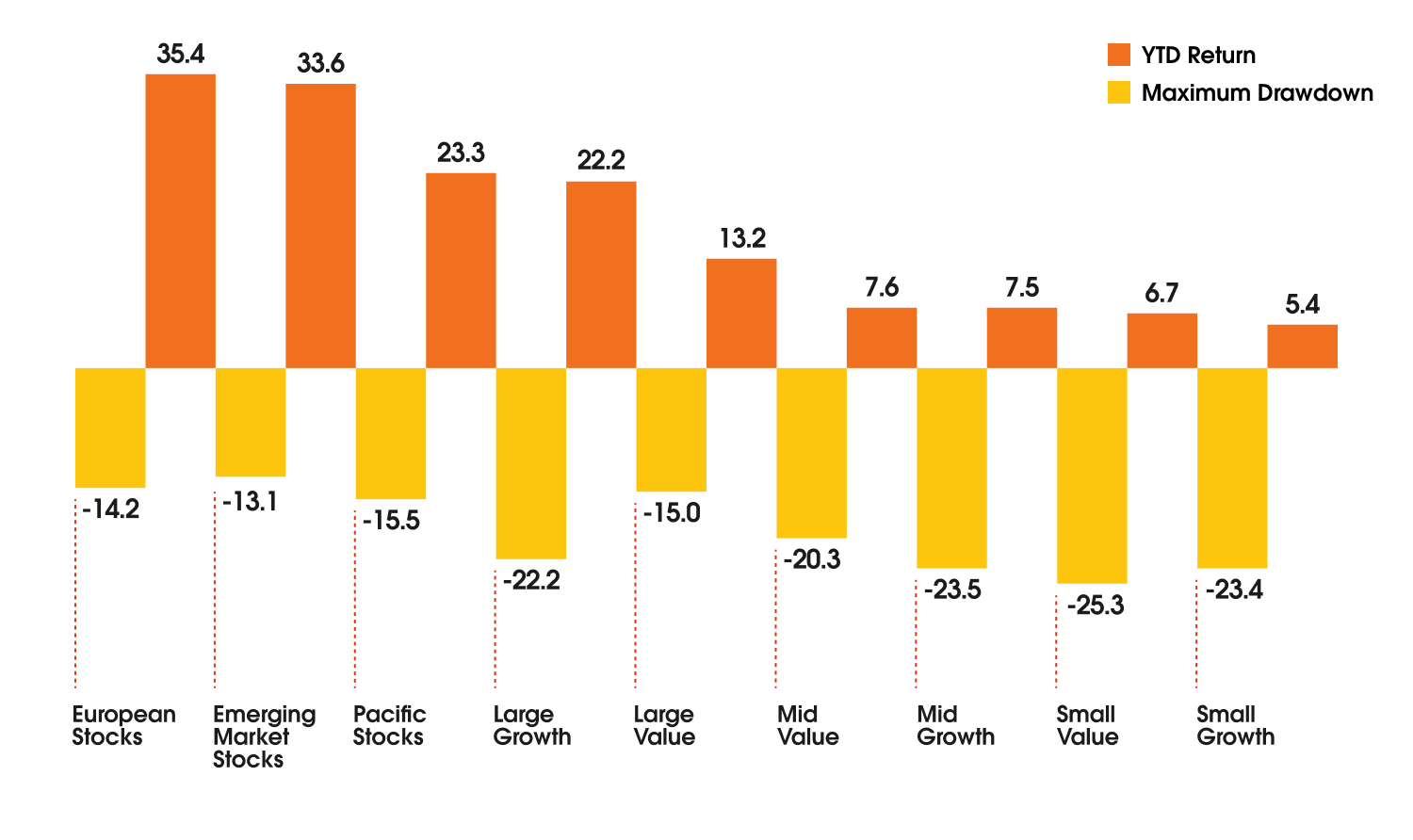

2025 max drawdown and YTD return by asset class index

Jan. 1, 2025-Dec. 31, 2025

Source: MSCI, Morningstar Direct, S&P Dow Jones Indexes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. Past performance does not guarantee future results.

Maximum drawdown is a key risk metric to show the largest peak-to-trough decline in an investment’s value over a specific period of time. Performance and drawdown figures based on daily total returns for underlying indexes.

TARIFFS, TRADE WARS AND TURBULENCE

The volatility surge was sparked by a flurry of tariff announcements from the U.S., followed by retaliatory moves from global trading partners. The ripple effects were immediate: Market-based inflation expectations jumped, bond markets priced in fewer rate cuts and stock markets tumbled. International stocks weren’t spared either. Developed and emerging markets felt the sting of trade tensions. But for U.S. investors, the pain was softened by a declining dollar, which gave a boost to global equity returns.

MARKETS MOVE FAST – AND SO CAN RECOVERIES

Just like a roller coaster’s twists are powered by energy, gravity and friction, global markets are driven by a complex mix of economic data, policy decisions and investor sentiment. And as we saw this year with the S&P 500, sharp drops can be followed by swift rebounds. As the tariff drama played out, markets seemed to shift their focus back to fundamentals: corporate earnings, inflation data and the Fed’s next moves. In any case, stocks slowly climbed back uphill.

ZOOMING OUT: A SMOOTHER RIDE?

When the final numbers for 2025 roll in, many equity asset classes may likely show solid gains. But for investors glued to daily headlines, the ride may have felt more like a stomach-churning plunge than a steady ascent. That’s why we always emphasize long-term perspective. Zoom out, and those wild swings can start to look more like gentle hills. The key is to stay buckled in: diversified, disciplined and focused on your goals.

Indexes for chart labels: European Stocks - MSCI Europe NR USD, Emerging Market Stocks - MSCI EM NR USD, Pacific Stocks - MSCI Pacific NR USD, Large Growth - S&P 500 Growth TR USD, Large Value - S&P 500 Value TR USD, Mid Value - S&P MidCap 400 Value TR USD, Mid Growth - S&P MidCap 400 Growth TR USD, Small Value - S&P SmallCap 600 Value TR USD, Small Growth - S&P SmallCap 600 Growth TR USD.

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

An index is a portfolio of specific securities (such as the S&P 500, Dow Jones Industrial Average and Nasdaq composite), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

Past performance does not guarantee future results.

AM5073912