Predicting a Recession Is so Easy, Anyone Could Do It

It’s the details that will get you.

Article published: January 05, 2026

If you’ve been feeling uneasy about the economy lately, you’re in good company. Whether it’s tariffs, inflation or the national debt, there’s a lot going on that will be felt in the economy somehow.

So as we go into 2026, many people are wondering: “Is a recession coming?”

And the answer is: Almost certainly.

Oh, you wanted to know when there will be a recession? That’s impossible to answer.

Recession talk usually has an ominous note of winter-is-coming impending darkness. So let’s shine a little more light on it.

WHAT IS A RECESSION ANYWAY?

Technically, recessions are officially called by the National Bureau of Economic Research, whose definition involves (deep breath) … “a significant decline in economic activity that is spread across the economy and that lasts more than a few months” with “three criteria – depth, diffusion, and duration – [that] need to be met individually to some degree.”

Notice that they’re not the National Bureau of Economic Forecasting. Recessions are only declared once they’re well underway, and sometimes after they’re over. Since 1980, NBER has called “the bottom” an average of 15 months after it happened. That’s just how long it takes to get a full picture of all the data (which, by definition, happened in the past) and analyze it with confidence.

Recessions also have the popular informal definition of two consecutive quarters (so, six months straight) of a shrinking U.S. economy.

Do markets often fall and people often lose jobs during recessions? Historically, yes. (Inflation typically tends to go down.) That’s why they’re scary for regular people who, let’s be frank, aren’t actually directly impacted by contracting GDP.

But job losses and market downturns don’t always occur to the same extent. And the downstream impacts of recession aren’t the only things that vary – the length and severity of recessions aren’t always the same either.

ARE WE DUE FOR A RECESSION?

Yes … and no.

As we said, there will always be a recession up ahead somewhere. That’s just how a cyclical economy works. Even in the middle of summer, winter is always coming.

But recessions don’t show up on a regular or predictable schedule. Since World War II, we’ve had 13 U.S. recessions. That’s one every six years on average. The last one was the Covid-caused two-month minirecession of 2020. The one before that was the era-defining Great Recession that started in 2007 and lasted a year and a half. If there’s ever been a good example of how no two recessions are the same, that would be it.

WHAT WILL HAPPEN IF WE DO HAVE A 2026 RECESSION?

Broadly, it’s likely that stocks could fall and bond returns could go up. But not all stocks or even all kinds of stocks may fall to the same extent. For example, “value” stocks (which tend to be older, more established companies whose stock price is predicated on current revenues, not promises of future growth) may perform better than growth stocks.

The variance in expected stock and bond returns, and in the different returns for different types of stocks, are exactly why we believe so strongly in diversification. It won’t stop your portfolio from falling in a down market, but it could help temper the pain.

In the event of recession, it’s also likely that there would be continued job losses, which we’ve already seen in 2025. The personal impact of that depends almost completely on whether you’re affected. As Harry Truman once said, “It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”

Earlier this year, we offered tips that can help you prepare for a potential job loss if you’re concerned you might be at risk or if you’ve unfortunately already experienced one.

IF WE’RE PREDICTING A RECESSION, WE HAVE TO PREDICT THE RECOVERY TOO

There’s one thing all recessions have in common – they’ve always come to an end. In fact, it happens relatively quickly in the grand scheme of things; since the Great Depression, no recession has lasted longer than two years and most are much shorter.

Any down markets (recession-related or otherwise) have likewise ended. The market has historically resumed its march upward and carried investors who stuck with it. That’s the power of patience.

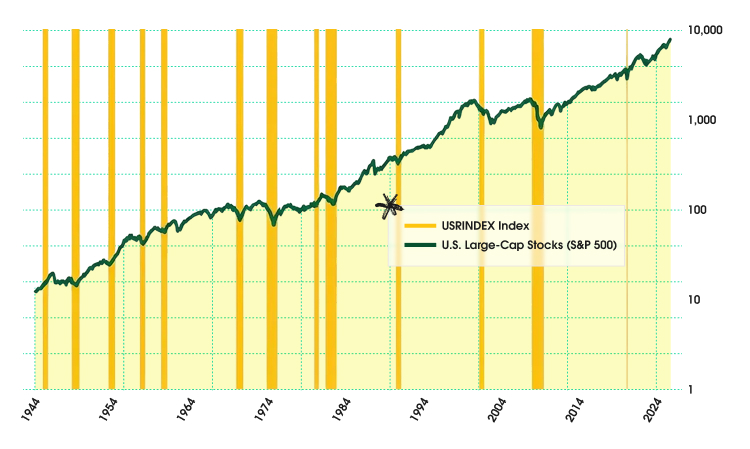

Staying invested: Equities historically have fallen during recessions, but have recovered over the long term

Source: Bloomberg, NBER, S&P Dow Jones Indexes; as of Oct. 31, 2025

USRINDEX indicates recessionary periods as defined by the National Bureau of Economic Research. Indexes are unmanaged portfolios and investors cannot invest directly in an index. Past performance does not guarantee future results.

Don’t get us wrong: Recessions matter. We all want to know when we’ll next have a recession because there are real human impacts – to our jobs, home values, retirement portfolios and more.

But no one can tell you with any certainty when they will happen.

If history is a guide and the six-years average holds, each American will likely live through 12 or 13 recessions. You’ve probably already been through a handful or more. You’re a recession survivor.

And in our view, there’s no better way to prepare to survive another one than by staying invested, in a diversified portfolio, with eyes focused on your financial future. If you need any help doing that, we’re here.

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

An index is a portfolio of specific securities (such as the S&P 500, Dow Jones Industrial Average and Nasdaq composite), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

Past performance does not guarantee future results.

AM5078127