Average Retirement Savings by Age: Are You on Track?

See how you stack up when it comes to retirement.

Article published: September 09, 2025

Retirement Planning at Any Age

If you think you’re behind or you’re just not sure, that’s where a financial advisor can help. All you need is a retirement vision and the motivation to go after it.

A lot of people wonder if they really know what they’re doing when it comes to money. After all, very few people get special training on how to handle it.

One of the biggest questions you might have is, “Am I saving enough for retirement?” An imperfect way to try to answer that question is to compare yourself to peers and see how you stack up.

To be clear, saving more than average doesn’t mean you’re doing everything right, and saving less than average doesn’t mean you’re doomed. But it’s human nature to compare and doing so may give you a sense of where you’re at and where you’d like to be with your savings.

WHY KNOWING THE AVERAGE RETIREMENT SAVINGS BY AGE MATTERS

We’ll let you in on a little secret: It ... doesn’t? Not really.

It could be motivating, and that’s great! Or it could make you feel proud of the work you’ve put in so far. But when it comes down to it, data like the average 401k balance by age is just a number and doesn’t tell you anything about the very personal financial journey you’re on.

The amount of savings you’ll actually need, for example, depends on things like:

- Will you have a pension?

- Will anyone else financially depend on you in retirement?

- Will you be in a high or low cost of living area?

- Do you plan to have expensive hobbies, like world travel, or cheaper ones, like pickleball?

That said, pretty much everybody agrees that more savings is better than less. And if you think you’re behind the 8-ball, you’re in the majority – 57% of Americans working full-time, part-time or who are temporarily unemployed feel the same as you.

So, let’s look at what the data says about average retirement savings, keeping in mind that we’re all doing the best we can.

AVERAGE RETIREMENT SAVINGS BY AGE

Let’s review what the Federal Reserve’s Survey of Consumer Finances tells us about the average retirement savings by age. Note: The average calculation is impacted by the outliers in the group so when that number is higher than the median, there are individuals with higher savings amounts pulling the average value up. The median or “middle point” can provide better insight on what is typical for the specified group.

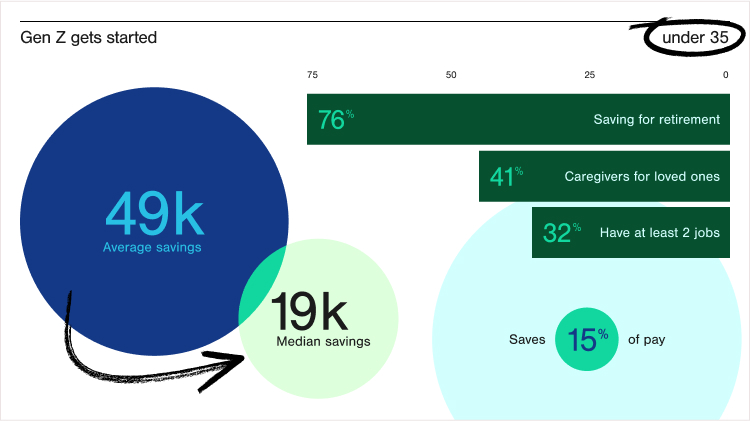

UNDER 35

Average retirement savings: $49K

Median retirement savings: $19K

This group is mostly Gen Z:

- Started saving at age 20

- Saves 15% of pay

- 76% are saving for retirement

- Big challenges: 32% have at least 2 jobs, 41% are or were caregivers for loved ones

In this age group? Start strong:

- Start saving as soon as you can (but pay high interest debt down and start an emergency fund first!)

- Get your employer match – it's free money

- Consider a Roth vs traditional 401k and whether it makes sense to pay taxes now while you may be in a lower tax bracket

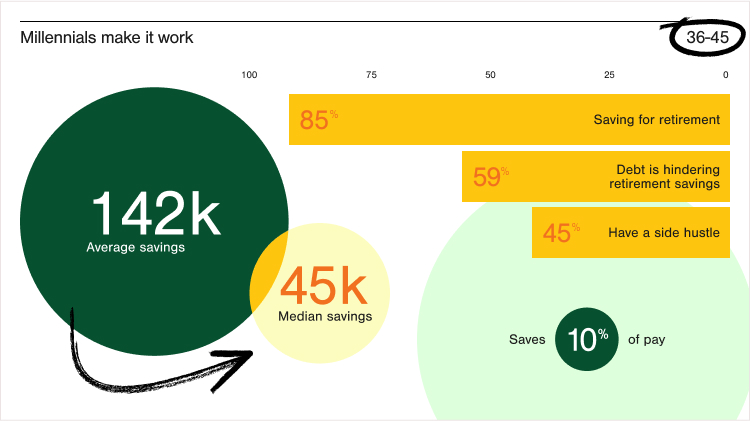

AGES 36–45

Average retirement savings: $142K

Median retirement savings: $45K

This group is the Millennials:

- Started saving at age 26

- Saves 10% of pay

- 85% are saving for retirement

- Big challenges: 45% have a side hustle for extra cash, 59% say debt is interfering with their retirement savings

In this age group? Keep it going:

- Increase your contributions every year. Try to get up to 15% or more for the best chance at reaching your goal.

- Watch out for lifestyle inflation! A small amount of additional retirement savings now can give you a lot more breathing room later. But the value of that time is dwindling.

- Double-check your investments to make sure you’re getting the full value of market-driven compounding (and that you’re not overpaying for your funds).

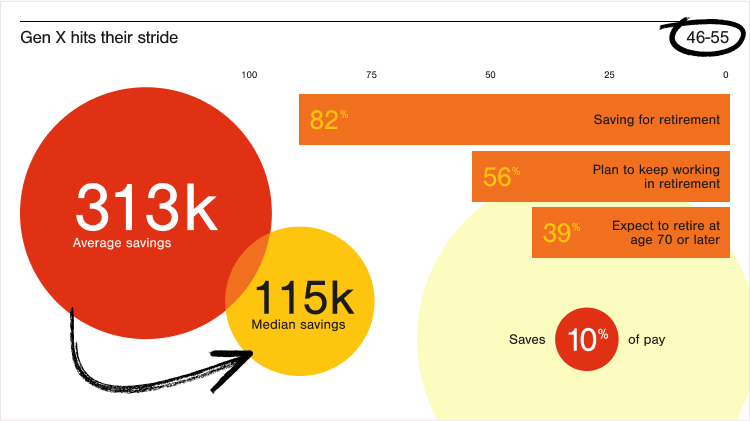

AGES 46–55

Average retirement savings: $313K

Median retirement savings: $115K

This group is Gen X:

- Started saving at age 30

- Saves 10% of pay

- 82% are saving for retirement

- Big challenges: 39% expect they won’t retire until age 70 or later, 56% plan to keep working in retirement

In this age group? Find a balance:

- Other priorities like college savings or helping aging parents can start to compete with retirement savings. Remember, you can’t get a loan for retirement! But you can juggle multiple goals with the right plan.

- Pay attention to tax strategies for your retirement savings – your 40s are typically peak earning years and you might be overpaying.

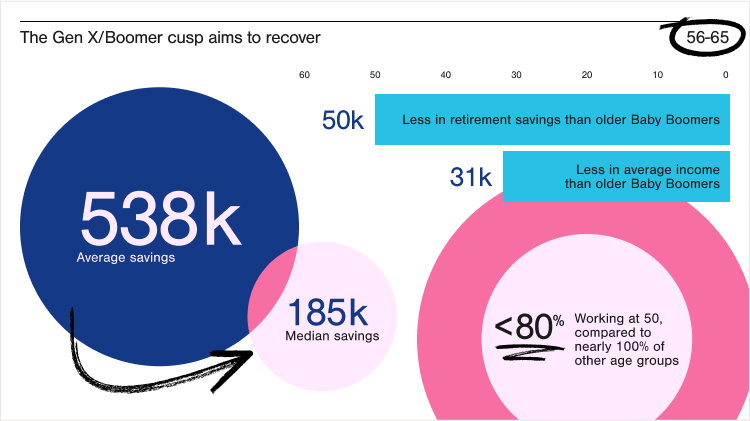

AGES 56–65

Average retirement savings: $538K

Median retirement savings: $185K

This group is a combo of older Gen X and younger Baby Boomers, who were hit hardest by the Great Recession. In their 40s at the time (hello, peak earning years), they never recovered from job losses and housing wealth decreases.

In this age group? Get into high gear:

- Starting at age 50, you can make extra “catch up” contributions to retirement accounts. Without the gift of time, a big commitment to saving is the best way to make an impact.

- Also think about other components of your retirement plan that might need to be addressed early, like long-term care insurance or Roth conversions.

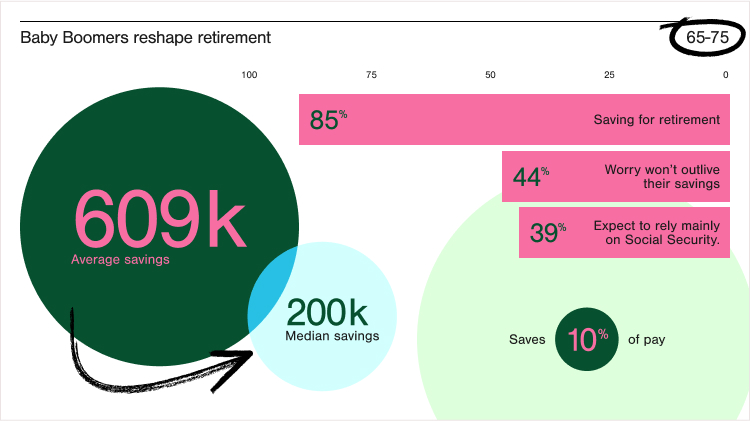

AGES 65–75

Average retirement savings: $609K

Median retirement savings: $200K

This group is the Baby Boomers:

- Started saving at age 35

- Saves 10% of pay

- 85% are saving for retirement

- Big challenges: 44% worry they will outlive their savings, 39% expect to primarily rely on Social Security

In this age group? Make it last:

- You may have income from Social Security and even a pension on top of your retirement savings. Be strategic about combining them to get the biggest bang for your buck.

- Before age 73, learn about required minimum distributions from your retirement accounts and how they could affect your taxes.

HOW MUCH SHOULD YOU INVEST IN YOUR 401K?

If you have access to a 401k or similar plan like a 403b, it's the best way to save enough money for retirement.

When you’re young, it’s impossible to know how much you’ll eventually need. So, focus on just saving as much as you can. A savings rate of 10%-20% of your income is a good target (including any employer match).

As you get closer to retirement, you can use calculators to give you an idea of an appropriate amount to save. Better yet, speak to a financial advisor for a personalized target and plan to get there.

The annual contribution limit for a 401k may seem out of reach, but strive to make it happen! Ideally, you’ll have a period right before retirement where your income is at its peak and other goals like college and a home are already paid for.

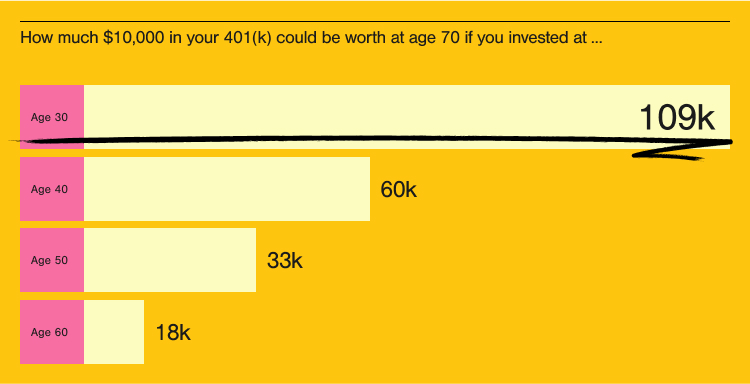

WHAT’S A GOOD RATE OF RETURN ON YOUR 401K?

When you invest the money you save in your 401k, that’s when the magic happens. Compounding goes to work and allows your relatively small savings to grow enough to support your retirement – if all goes as planned.

Your rate of return will depend on what you’re invested in and how the markets do. And it won’t be the same all the time. Many retirement calculators use a standard after-inflation rate of return that’s based on historical averages.

At 6% a year, here’s what a $10,000 investment could grow to by age 70, depending on when you make it.

- Age 30: $109,575

- Age 40: $60,226

- Age 50: $33,102

- Age 60: $18,194

That’s why we always say that time is on your side!

CONTRIBUTION LIMITS TO KNOW FOR 2025

IRAs, including traditional and Roth

For most people: $7,000

If you’re at least age 50: $8,000

401ks and similar employer plans

For most people: $23,500

If you’re at least age 50: $31,000

If you’re age 60–63: $34,750

FALLING BEHIND? 4 WAYS TO CATCH UP

Give yourself grace if you think you’re failing at retirement savings. Many people don’t start saving until their 30s or 40s! And no matter how old you are, it’s never too late – every little bit helps. Here are some ways to engage now, at any age:

- Raise your contributions every year. Increasing by 1 percentage point each year (for example, going from a 4% to 5% payroll deduction) is a relatively painless way to make a big difference over time.

- Use bonuses or tax refunds to jumpstart your savings. By putting large “windfall” amounts into an IRA, you might not even notice the difference in your budget.

- Use an IRA or brokerage account if your employer plan is maxed out. 401ks and 403bs have large annual limits, but if you need to save more because you’re running out of time, consider other kinds of accounts. IRAs can have tax benefits but can also have restrictions; brokerage accounts are open to anyone for any reason.

- Meet with a financial advisor. They can tell you exactly how much you personally should be saving and even find extra money hiding in your budget; for example, cheaper investments or tax breaks you didn’t know about.

TRACK YOUR PROGRESS, NOT JUST THE AVERAGES

Comparing yourself to peers is an easy way to gut-check whether your progress is reasonable. But don’t get carried away, and – just like mom always said – don’t worry too much about what other people are doing.

Your journey and your needs are unique. By taking small steps, being proactive and checking in regularly, you can get on the right path to achieving your dream retirement.

If you’re still not sure where you stand, working with a financial advisor can give you the confidence that you’re headed in the right direction. They can provide expert guidance, help you adjust your strategies as needed and keep you motivated. So, keep your eyes on your own prize, focus on your progress and watch your financial journey unfold!

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

Neither Edelman Financial Engines nor its affiliates offer tax or legal advice. Interested parties are strongly encouraged to seek advice from your qualified tax and/or legal professionals to help determine the best options for your particular circumstances.

AM4828294