What’s up With Work?

Side-eyeing the job market’s uncomfortable balance.

Article published: January 05, 2026

“This time is different.” “Welcome to the new normal.” Unless you’re new here, you’ve heard that before.

In 2025, it really did feel like it might be true when it comes to work, at a fundamental level. AI stole most of the headlines, but it was also helping mask changes driven by immigration patterns.

It’s worth asking: Are we really seeing a fundamental shift in the nature of work or just another economic cycle? Let’s look at the facts.

2025: A YEAR OF WORKFORCE WHIPLASH

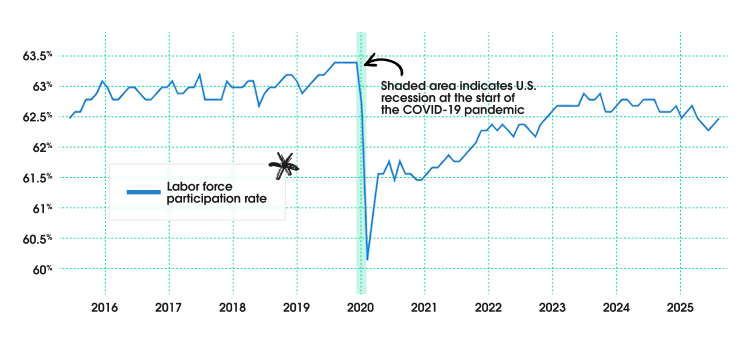

This year brought some dramatic changes to the labor market: Job creation slowed to a trickle, with just 22,000 new jobs in August – a steep drop from 2024’s pace. But the number of workers also shrank, thanks to falling immigration and declining labor force participation, reversing post-pandemic trends.

And despite younger generations’ cultural embrace of job-hopping, the rate at which people quit jobs has fallen thanks to a new opposing phenomenon dubbed “job hugging:” When jobs seem more scarce, if you can’t be with the one you love, you love the one you’re with.

Fewer workers: A smaller share of Americans are looking for work

Source: U.S. Bureau of Labor Statistics via Federal Reserve Economic Data, Federal Reserve Bank of St. Louis

Meanwhile, anxiety ramped up: Consumer sentiment plunged 30% from November 2024 to November 2025. Big Tech layoffs made headlines; Amazon, Microsoft and Meta announced tens of thousands of job cuts, citing AI and automation. October layoffs hit 150,000, nearly triple the number from a year earlier, according to jobs firm Challenger.

THE DATA TELLS A MORE NUANCED STORY

There are actually two big trends counteracting each other: Labor demand (companies that want to hire) is softening, but labor supply (people available for work) is also shrinking. That’s why unemployment remains modest – between 4.1% and 4.3% in recent months. So while switching jobs might be tougher, most people who want to be are still employed. In other words: The job market isn’t booming, but it’s not collapsing either.

LOOKING AHEAD: CAUTIOUS OPTIMISM

Despite inflation and tariff uncertainty, the economy has managed a soft landing so far. Consumer spending remains healthy, and investment in AI continues to grow. That’s keeping momentum alive.

Still, risks remain: Trade wars could escalate. Job losses could accelerate, hurting household spending (and the people in those households!). But here’s the key takeaway: The labor market ≠ the economy, and the economy ≠ the stock market. Even if AI leads to job cuts, corporate profits could still grow, driving stock market gains. That’s why we believe in preparing for multiple outcomes, not betting everything on one prediction.

THE SHORT-TERM FUTURE OF WORK

Job losses are painful. And it’s clear some jobs are already being reshaped or replaced by automation and AI.

But it’s still unclear whether aggressive AI adoption will deliver the profits companies expect. As with any tech trend, some firms will overshoot and need to recalibrate.

As an employee, you can take steps to be prepared for a potential layoff or structural change in your industry. As an investor, you can also plan for a variety of potential outcomes, because we really don’t know yet what will happen with the broader economy. Stay invested. And diversify broadly, considering investments in and outside of tech, and always with your plan and goals in mind.

This material was prepared for educational purposes only. Although the information has been gathered from sources believed to be reliable, we do not guarantee its accuracy or completeness.

Investing strategies, such as asset allocation, diversification or rebalancing, do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. All investments have inherent risks, including loss of principal. There are no guarantees that a portfolio employing these or any other strategy will outperform a portfolio that does not engage in such strategies.

Past performance does not guarantee future results.

AM5079304

.png)